Over the almost 5 years since Statutory Accident Benefit disputes were moved to the Licence Appeal Tribunal (LAT), I have been tracking (and blogging about) different LAT statistics.

This blog post will compare Ontario automobile insurer market shares against the amount of LAT Applications (to start a LAT dispute) and LAT Decisions (which end a LAT dispute). In other words, how are the biggest insurers behaving on automobile insurance claims from their own insureds? Which insurers are denying the most claims? And, which insurers play hardball with their insureds all the way up to a LAT hearing and decision?

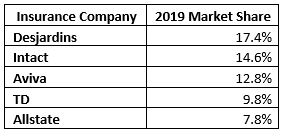

According to the 2020 Canadian Underwriter Statistical Issue, the top 5 market shares for private passenger automobile insurance in Ontario for 2019 are:

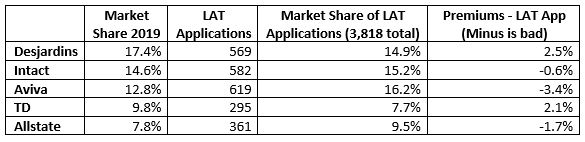

We can then compare the market shares of these large insurance companies to the amount of LAT Applications that are generated against them (i.e. when they deny claims). For the amount of LAT Applications, we will use the latest Freedom of Information (FOI) statistics that we have (2020-21 Q1).

A “minus” number in the far-right column means that the insurance company’s market share of LAT Applications against them is higher than their market share of premiums. In other words, they have a higher amount of disputes than they should have based on their overall amount of customers and premiums.

The comparison of market share against LAT Applications, frankly, does not look too bad for any of the insurers. Aviva looks the worst, but, there is only a 3.4% difference.

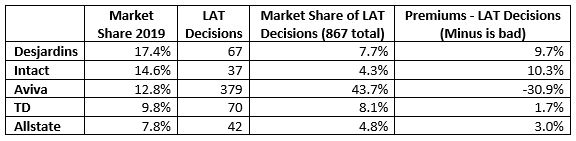

BUT, if we look at a comparison of market share against LAT Decisions, the picture is much worse (for one big insurer).

As of January 28, 2021, there were 867 automobile insurance LAT Decisions reported on CanLII for 2020. So, a similar market share analysis was done for the LAT Decisions. In other words, which insurance companies take a hardline approach against their own insureds and not only deny claims, but, stand firm in their denials taking them all the way to a LAT Decision?

Aviva accounts for 379 of the 867 decisions (or 43.7%). That is for a company with a 12.8% market share.

The Aviva stats are far different than the other large insurers (whose market share of Decisions is actually a lower percentage than their market share of premiums). This has an impact on Aviva’s insureds (customers) and also on the LAT system itself.

Disputes that go all the way to a decision cause a disproportionate strain on the LAT system. They take up more LAT time and resources. They add to the LAT’s significant backlog. See Updated LAT Statistics.

Obviously participants in legal disputes have a right to have their case heard. But, these statistics show that Aviva is using an extreme, hardline approach to automobile insurance disputes with their own insureds. Remember, there is a duty of the utmost good faith that governs both insurance companies and their insureds. And, automobile insurance legislation (like the SABS) is consumer protection litigation. On that background, these stats are even more sobering.