If you didn’t know that your automobile insurance benefits were reduced on June 1st, you are not alone. A recent survey conducted by the Insurance Brokers Association of Ontario (“IBAO”) revealed that only 42% of consumers had heard about the changes and less than 20% could actually identify what those changes were. All Ontario drivers need to be familiar with these reductions to auto insurance coverage and need to know that optional benefits exist to restore coverage.

What important changes should I know about?

Here is a brief recap of the reductions to standard Accident Benefit coverage:

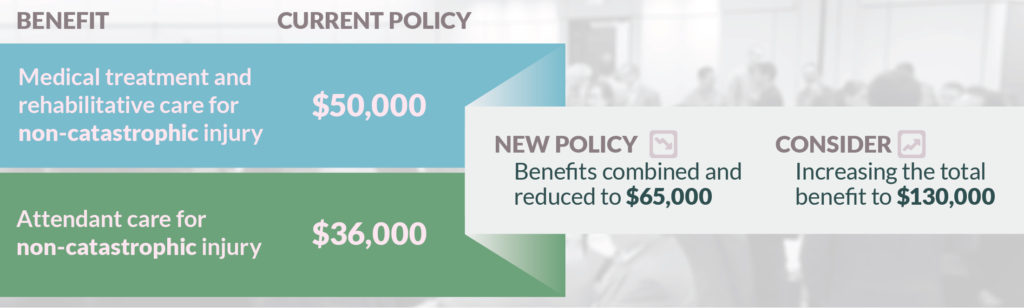

For non-catastrophic injuries, policies before June 1, 2016 provided for $50,000 in medical and rehabilitation benefits and an additional $36,000 for attendant care benefits. These benefits have now been combined to a reduced total of $65,000. It is anticipated that by combining these benefits and reducing their monetary limit, many accident victims will now have to choose between receiving personal health care assistance and the rehabilitation treatments they require to aid their recovery. In most cases, there is simply not enough coverage to receive both under the shared limit of $65,000.

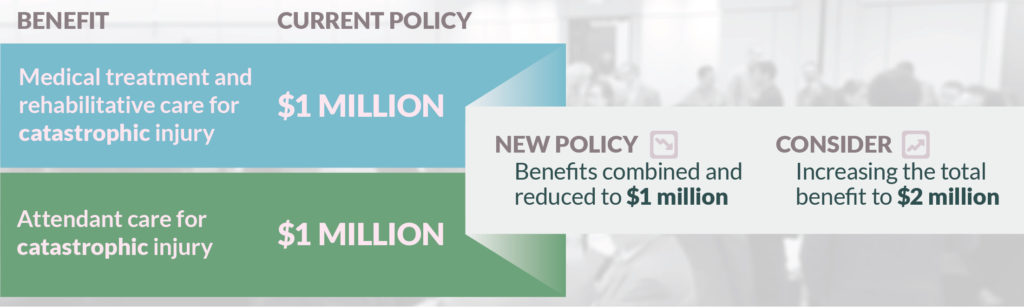

Prior to June 1st, the most seriously injured accident victims who have suffered catastrophic injuries, had $1 million available for medical and rehabilitation benefits and an additional $1 million to use towards attendant care. The new changes have also halved these benefits to a combined total of $1 million. Essentially, the new standard slashes $1 million of coverage from those who need it most. The $1 million shared limit is not sufficient for those who are catastrophically injured and require a high level of care.

A quick reference chart outlining the recent changes and upgrade options is available on the FSCO website.

What happens to my auto insurance policy as of June 1, 2016?

Although the changes to Accident Benefits are effective June 1, 2016 it is important to take note of your policy renewal date. Those with policies that have renewed prior to June 1st will continue with the same level of standard coverage as before the reforms came into effect. The changes do not apply retroactively or supersede the coverage under policies that have already been renewed prior to June 1. If, for example, you have an accident on July 10th but your policy renewal date is September 3rd, your old coverage will still apply. When your renewed policy comes into effect, your benefit limits will then reflect the reductions. Therefore, the standard benefits available to individuals involved in collisions after June 1st may be considerably different depending on when their policies renewed.

What can I do to ensure I have the right coverage?

Educate yourself. You can purchase optional benefits to increase your coverage limits.

Speak with your insurance company, broker, and others who are familiar with the changes to make an informed decision about the amount of coverage you need to protect yourself and your family. According to the IBAO survey, only about 37% of people felt confident that they could research and choose the right insurance policy for their situation and needs on their own.

As a lawyer who represents injured accident victims, I encourage you to be proactive to ensure you understand the insurance policy you are paying for including the level of coverage and benefits available. Taking the time now will avoid learning that you do not have the protection you expected after being involved in an accident when it is too late.

What should I consider and what is the cost?

Consider purchasing optional benefits. The fact is that the standard coverage limits are no longer adequate for most consumers if they are seriously injured. When you renew your policy, purchase the right options to suit your specific circumstances and lifestyle.

You will find that upgrading to enhanced benefits is relatively inexpensive.

From my own experience, I found that I could increase the combined medical rehabilitation and attendant care limit for non-catastrophic injury from $65,000 to $130,000 for about $33 per year. I also had the option of increasing this coverage to the maximum available amount of $1 million for about $65 per year.

For catastrophic injury coverage, I found I could increase the standard $1 million worth of medical rehabilitation and attendant care to $2 million for only $38 per year.

Basically, for about $100 per year, I could increase my coverage limits to the maximum available.

Although the cost of “enhanced” benefits will vary based on individual factors, most people I have talked with have had quotes within a similar range.

4 Comments