Guest Author: Kennedy Nolan, Nolan Ciarlo LLP

New data reveals that car accidents in Ontario have gone down by more than 56% since Ontario’s State of Emergency was declared on March 17, 2020.

How have car insurance companies responded? By increasing Ontarians’ premiums by an average of $30 per policy since the pandemic began.

With Fewer Cars on the Road, Accidents Are Way Down

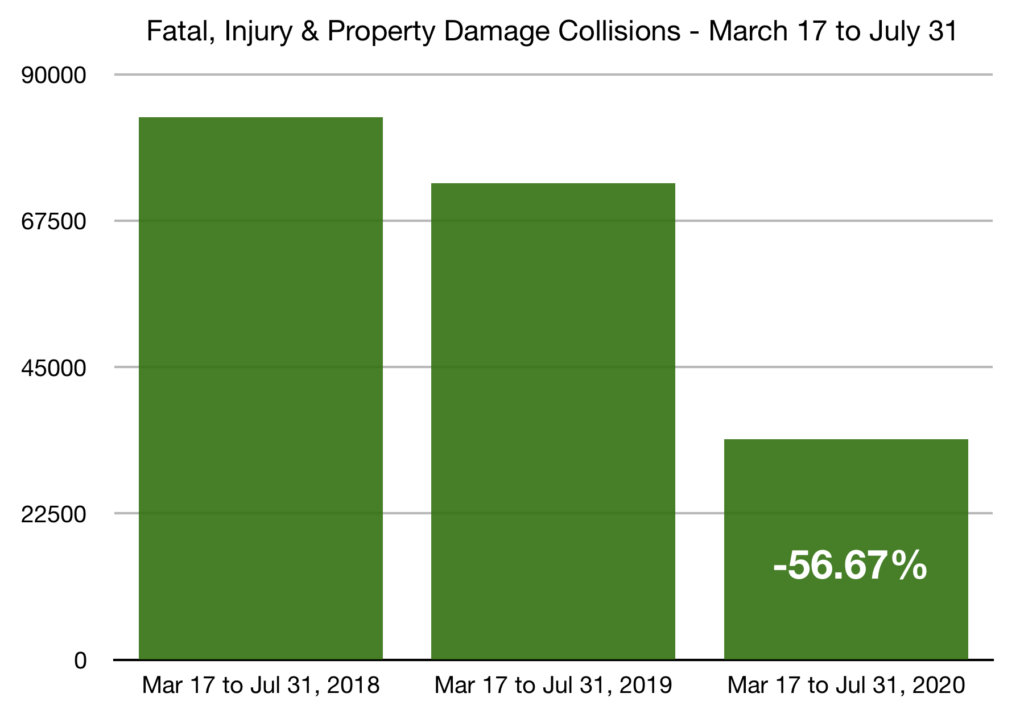

Preliminary numbers provided by the Road Safety Research Office at Ontario’s Ministry of Transportation show a drastic decline in the number of car accidents involving fatalities, injuries and property damage from March to July of 2020 (the most recent month for which data was available), compared with the same period in 2018 and 2019.

All together, the preliminary statistics reveal that reported collisions have gone down by over 56% compared with the past two years.

Savings Are Going to Insurance Companies, Not to Consumers

Fewer collisions means fewer new insurance claims.

For years, car insurance companies have argued that rising claims costs are the reason they can’t provide premium relief to consumers. So we should expect to see substantial savings to consumers on their insurance premiums with the reduced numbers. Right?

Insurance companies (along with the industry’s regulatory cheer-leader, the Financial Services Regulatory Authority of Ontario – FSRA), have made a big show of touting the temporary rebates some consumers have been offered during the pandemic to supposedly offset the savings insurers have been enjoying. But the numbers reveal that the (very modest) consumer savings are illusory: according to the latest regulatory filings, the average car insurance premium in Ontario has actually increased by $30 – about 1.8% – since last year!

As for those temporary rebates, the available relief has been minimal and has varied widely across the industry. It turns out that over 460,000 Ontarians have seen no relief whatsoever (see more). For one large insurance company, fewer than 63% of their consumers have received any money back at all.

Meanwhile, for those who do get some relief, the rebates are trivial: in many cases, people are getting back less than 5% of their total premium costs. In total, Ontario’s insurance regulator reports that insurers are expected to reimburse just 7.1% of the premiums they have taken in.

So we have a 56% drop in collisions… but only a 7% temporary credit on premiums. And, overall, premiums are actually going up this year by 1.8%. How is this fair?

Profiting Off the Pandemic

A few months ago, Ontario imposed new rules to crack down on pandemic price gouging. The rules apply to a number of essential consumer products. Maybe it’s time to add compulsory services like auto insurance to the list.

Ontarians are hurting financially due to massive layoffs, widespread business closures, and an unprecedented economic slow-down. Meanwhile, car insurance companies are enjoying substantial savings and growing profit margins. It’s unconscionable to see these massive companies taking advantage of struggling consumers like this.

It’s important to remember the broader context for these growing insurer profits:

- A recent report revealed that, even before COVID-19, Ontario car insurance companies were already making huge profits, and Ontarians were overpaying for their coverage.

- Ontarians’ premiums have been going up consistently for years (see more).

- On the flip side, the protection Ontarians get in exchange for paying their premiums has been steadily reduced by successive provincial governments, with millions of dollars in benefits eliminated from the average consumer’s policy over the last several years (see more). At the same time, the legal rights of accident victims have been hacked away beyond recognition.

It’s Time to Rebalance the System

For years, insurance companies have profited while consumers and accident victims have been repeatedly screwed-over. With this latest debacle, it’s clearer than it’s ever been that it’s time to rebalance the system.

This isn’t really about one-off rebates and short-lived premium reductions, even if that’s the discussion insurers want us to be having. When looking at the problem of unfair insurance company profits, we need to look at structural changes to restore the balance in our system by putting consumers and accident victims first.

Instead of letting insurance companies use their pandemic savings to further increase their profits, the savings should go towards fixing the unfairness in our system. Things like:

- Eliminating the secret and growing “deductible” – a perverse rule that literally gives injured people’s money to the insurance company of the negligent drivers who hurt them (see more on deductibles)

- Restoring the unfettered right of injured people to take negligent drivers to court to seek needed compensation from their insurance companies (see more on threshold)

- Restoring the right of injured people to sue their own insurance companies when insurance companies break their contracts and try to bully accident victims (see more on the LAT)

- Restoring the medical and care benefits for injured people that have been slashed by successive governments (see more on benefit cuts)

Above All: We Need Transparency

It’s admittedly hard to know exactly what a ‘fair, reasonable and justified’ premium is in Ontario, because it’s hard to know exactly how much profit insurance companies are making and how much they spend on claims.

The full details of insurance company profits and claims costs are a closely guarded secret in this province. The fact is, insurance companies aren’t required to disclose the truth about their profits.

At an absolute minimum, all the details about insurers’ profits and full claims costs need to be made public so Ontarians can judge for themselves the fairness of the premiums they are forced to pay – especially during the COVID-19 crisis.