OTLA President-Elect Adam Wagman recently appeared with Jerry Agar on Newstalk 1010, Scott Thompson of AM900 CHML, and also with Tom Hayes on Global News to speak about concerns with Ontario’s new auto insurance rules.

On June 1, 2016, in an effort to reduce insurance premiums in Ontario, the Provincial government has mandated changes to accident benefits. These changes include a $1 million dollar reduction to coverage for the catastrophically injured.

All of these changes warrant many questions. Here are some FAQs regarding the new rules.

This million-dollar change in medical rehabilitation and attendant care benefits could easily be the deciding factor in whether an injured person can afford adequate treatment to achieve recovery. It may mean putting family at risk financially, emotionally, and physically.

In explaining the high cost of auto insurance in Ontario, insurers are quick to blame “rampant” fraud. Except fighting fraud does not justify the decision to recoup losses from Ontario’s most vulnerable. The incoming changes are even harder to stomach when you see reports of the profits pocketed by Ontario insurance companies and their executives.

Many Ontarians are forced into poverty or kept there because of injuries

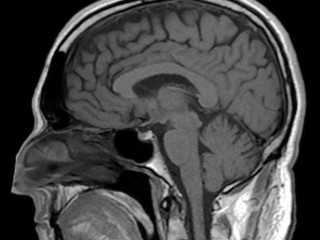

In his Newstalk 1010 interview, Adam asked “Why are we reducing the benefits for people in wheelchairs to pay for that fraud instead of combatting fraud?” He continued, “It makes absolutely no sense for our system to try to save money by taking that care away from someone in a wheelchair.”

The people who will be most affected by these cuts are the mentally and physically disabled and their families. This marginalized group is already one of the most vulnerable in our society, especially when considering those living in poverty. These survivors of trauma and those living in poverty are more vulnerable to PTSD, anxiety, and depression. Worse, these same people face more difficult recovery, and are more likely to develop other health issues like chronic pain.

Personal injury lawsuits and accident benefits are of vital importance to Ontario’s poor and disabled residents; they may not be able to rely on savings or that of their family, and instead require compensation to afford necessary treatment.

Ontarians need to know that the new rules allow you to purchase additional Optional Benefits, which bring your coverage back to $2M

Ontario drivers need to understand the consequences of these changes or else will risk being caught unaware and left vulnerable with inadequate coverage. In his interview with Tom Hayes on Global News, Adam says, “the worst thing that you want to hear from a client is ‘I didn’t know that I wasn’t covered’.”

3 Comments